As the coronavirus, COVID-19, continues to spread, organizations around the globe are facing mounting business disruptions and economic losses. Some of these entities may seek coverage for these losses under a variety of insurance policies. Coverage under any form will depend, of course, on the facts of the claim, policy wordings, and the applicable law. Here, we highlight some policy wordings insurers should keep in mind when evaluating coronavirus-related claims under various coverage forms.

A version of this article was originally published by our US alliance firm Hinshaw & Culbertson LLP. To view the original article please click here.

Insights for Insurers writing business in the US

It is highly unlikely that a coronavirus claim would be covered under a named peril property insurance policy, but insurers may receive business interruption and contingent business interruption claims under all-risk property forms. Those coverages, however, do not come into play in the absence of direct physical loss or damage to property. Insurers should also consider whether the policy contains a contamination or other similar exclusion. Coverage for lost income or profits should be examined under a Civil Authority or Ingress/Egress coverage extension, if applicable (see below).

As businesses continue to experience economic losses related to the coronavirus, allegations that directors and officers did not properly plan for, manage, or disclose coronavirus-related risks may emerge. Coverage for such claims under D&O forms, however, may be precluded by bodily injury and conduct exclusions. Commercial general liability policies may contain exclusions applicable to both Coverage A and Coverage B for claims arising out of communicable disease. Pollution and other exclusions should also be examined.

Coverage for business income losses under a Communicable Disease Endorsement typically will require the actual, not suspected, presence of a communicable disease at an insured location and a mandatory governmental order.

Coverage under a Civil Authority coverage enhancement will likely require off-premises property damage, as well as a civil authority order. An Ingress/ Egress coverage enhancement may not require an act of a civil authority, but physical loss or damage caused by a covered peril to property that prevents or hinders ingress to or egress from the insured’s business will be required. Supply Chain coverage is triggered by business interruption resulting from a disruption or delay in the receipt of products, components, or services from only a named supplier or supply. Physical damage may not be required, but the relevant suppliers and supplies must be scheduled, unless the form provides blanket coverage. In either case, coverage may be subject to a communicable disease exclusion.

Event Cancellation policies may contain an express coronavirus exclusion and/or a communicable disease exclusion. In addition, coverage may be excluded for any voluntary cancellations. Compliance with the policy’s notice provision – which typically requires prompt notice following discovery of any event likely to give rise to a claim – should be carefully considered in light of the well-publicized impacts of the coronavirus. Event Cancellation policies also typically contain a mitigation requirement, which may be relevant in certain circumstances.

New Jersey Legislature Considers Mandated COVID-19 Business Interruption Coverage

The first COVID-19-related insurance coverage cases are now being filed. In Louisiana, a

declaratory judgment action was brought against Certain Underwriters at Lloyd's, asking the Court to rule that an all-risk policy provides coverage to the Oceana Gill restaurant for losses resulting from the Louisiana Governor's proclamation of March 13, 2020 banning gatherings of 250 or more people in a single space, as well as restrictions implemented by the New Orleans mayor requiring restaurants to cease operations at 9 p.m. and limit seating capacity to 50%. The complaint alleges that the policy at issue "does not provide any exclusion due to losses, business or property, from a virus or global pandemic," and that it "only excluded losses due to biological materials such as pathogens in connection with terrorism or malicious use, therefore providing coverage to [sic] other viruses or global pandemics."

As stated above, insured entities likely will face an uphill battle when seeking coverage for COVID-19 losses under most commercial insurance policies.

Perhaps, in recognition of this reality, the New Jersey legislature is considering extraordinary legislation, Assembly Bill 3844, which would rewrite property insurance policies to provide coverage for COVID-19 business interruption losses—even policies that contain a virus exclusion.

As originally drafted, AB 3844 would apply to property policies that were in effect on March 9, 2020 and issued to insureds with fewer than 100 eligible employees in New Jersey. An eligible employee was defined as a full-time employee who works 25 hours or more in a normal work week. Pursuant to the bill, the “coverage required by this section shall indemnify the insured, subject to the limits under the policy, for any loss of business or business interruption for the duration of that declared State of Emergency.” The costs for any paid claims would ultimately be passed on to all insurers operating in New Jersey, except for life and health insurers.

UK Approach

The last few days have seen the UK government vacillate to a degree on the strategy for containing/supressing the virus, and the social distancing 'advice' has received a negative reaction from a number of industries in the context of insurance claims. Given the lack of government enforcement of a closure of bars, restaurants, theatres etc., there are significant question marks as to the impact on policy response, even where notifiable/communicable diseases are covered.

Where existing policies provide cover under a BI Extension for notifiable or communicable diseases or business closure orders, insurers have come under Governmental pressure to relax the requirements for the trigger.

The Financial Conduct Authority (FCA) has today set out expectations for general insurance firms and provided information for consumers about what they should see from their insurance provider during the coronavirus pandemic. See

here.

The Chancellor stated during yesterday’s coronavirus press briefing: “Let me confirm that for those businesses that do have a policy for insurance that covers pandemics that the government’s action is sufficient and will allow businesses to make an insurance claim against their policy.”

The Prime Minister made an even broader statement that insurers had “stepped up to the plate and understood that they have to pay out to those businesses”.

The Chancellor then appeared to clarify these statements during yesterday's Budget Select Committee hearing when he explained that at a meeting between the Government and (unspecified) insurers on 17 March, it had been agreed that the Government's advice to the public not to visit pubs, clubs and restaurants would be treated as an actual closure order. Accordingly, if a policy contained specific cover for BI losses caused by a closure order, that policy would be engaged. However, helpfully, the Chancellor also clearly stated that the Government could and would not retrospectively re-write an insurance policy so that it provided cover that did not presently exist within that policy. In other words, if the policy did not contain cover in respect of losses caused by a notifiable disease or a closure order, it would not be retrospectively re-written so that it did. In explaining that position, in answer to questions from the Select Committee, the Chancellor said that insurers will have written and rated risks on the basis of an agreed scope of cover and that requiring insurers to pay claims that were not within the scope of cover could result in solvency issues for insurers. He also added that the broad absence of insurance cover for BI losses caused by the pandemic was the reason why the Government had stepped in with substantial financial support for businesses.

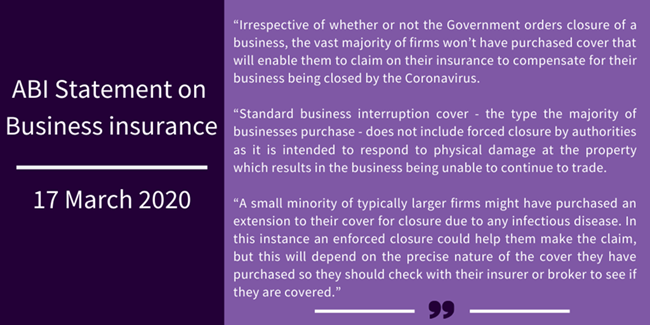

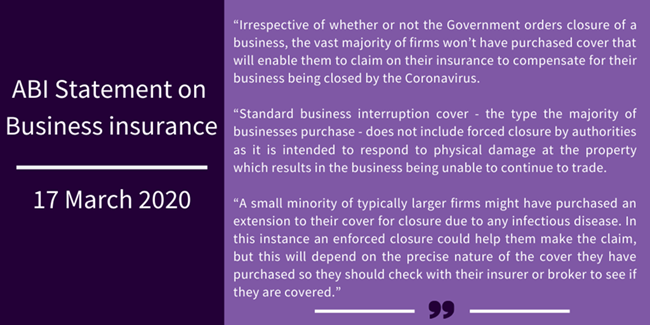

The impact on insurers of the 'concession' on policy triggers that appears to have been reached between the Government and insurers may not be that material in the scheme of things. As the ABI explained in their statement on Business Insurance on 17 March:

Commentary:

The UK Government's current position is that it will not introduce legislation requiring insurers to pay for coronavirus related BI losses that completely fall outside the scope of cover. That is helpful clarification at a time when insurers are assessing their financial exposure to the ongoing pandemic. In the US such radical legislation has been contemplated but, it seems, it has been stalled – at least for the time being. Hopefully, the UK Chancellor's warning about the consequences of fundamentally re-writing insurance policies on a retrospective basis will be heeded by other Governments.

This article is co-authored by RPC Partners Victoria Sherratt, Naomi Vary and Simon Laird alongside Hinshaw Partners Judy Selby and Scott Seaman.