Game theory and the art of litigation settlement (Part 3)

This article is the third in a series targeted at litigators that consider the issue of settlement in litigation through a game theoretical lens.

Article 3 - The impact of part 36 offers on settlement.

For the previous articles in this series please follow the links here and here.

Part 36 offers and how they work

A part 36 offer is a type of settlement offer set out in the CPR that carries specific cost consequences if the opponent fails to beat the offer at trial. Such an offer can be made by either the claimant or defendant. Such offers provide a short period, the 'relevant period', for the other to accept it after which adverse cost consequences follow if the offeree fails to do better than the offer at trial. Although certain aspects of the law in this area are nuanced, a high level summary is provided below.

Consequences of accepting a part 36 offer

If a part 36 offer is accepted within the relevant period the claimant receives the settlement amount specified in the offer plus the costs of the proceedings up to the date on which the offer was accepted (CPR 36.13(1)). If an offer is accepted but after the relevant period usually the claimant is awarded costs up to the date on which the relevant period expired and the offeree pays the offeror’s costs for the period from the date of expiry of the relevant period to the date of acceptance (CPR 36.13(4) and (5)).

Consequences of rejecting a part 36 offer

The consequences of not accepting a part 36 offer differ depending on whether it is the claimant or defendant's offer – both are summarised below.

|

Offeror |

Outcome if the other party does not accept the offer and fails to beat it |

|

Claimant |

The defendant pays:

(CPR 36.17(4))

Usually the court will order that the defendant pay the claimant's costs on the standard basis prior to the expiry of the 'relevant period'.

|

|

Defendant |

The claimant pays the defendant's costs on the standard basis[1] from the date on which the relevant period expired.

(CPR 36.17(3))

Usually the court awards enhanced interest on the defendant's costs. The court will also usually order the defendant to pay the claimant's costs of the proceedings that were incurred before the end of the 'relevant period'.

|

For the purposes of the calculations that follow enhanced interest is assumed to be 8%2. In the calculations underpinning the graphs that follow, the awarding of enhanced interest is factored in but for simplicity interest awarded at lower rates is not. Interest is calculated on a linear rather than compounding basis.

Impact of part 36 offers

Let us revisit the 50:50 case scenario from the earlier articles in this series, i.e. a £1 million claim where both the claimant and defendant agree that the claimant's prospect of success is 50% and where expected costs to trial for both parties are £300k each. We will also introduce a new assumption that the case would take two years to litigate to trial (as this timeframe is relevant to the interest calculations).

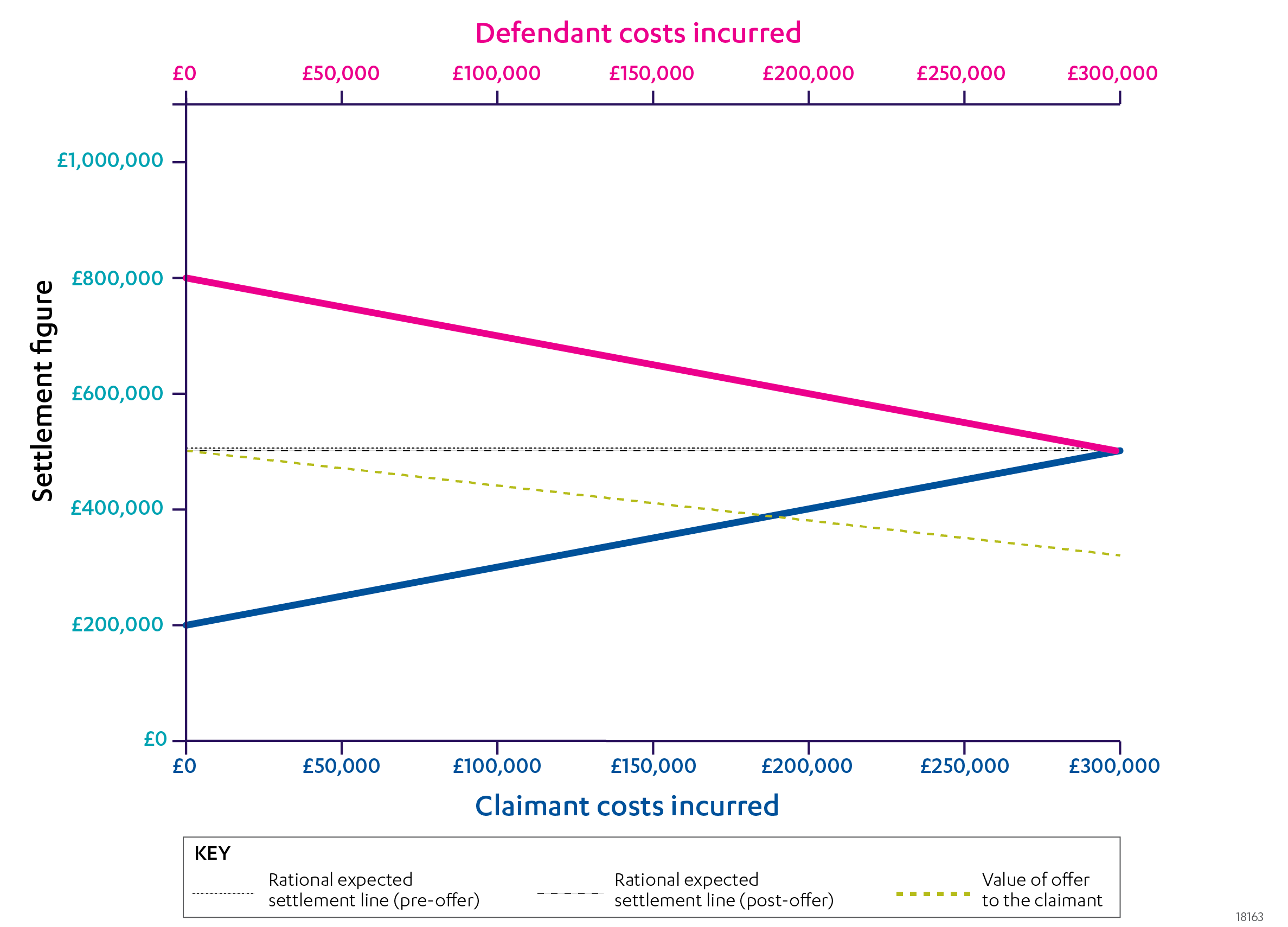

You may recall from previous articles that the rational expected settlement line (i.e. the level one would assume the parties would settle at given equal bargaining positions and risk appetite) in this scenario is £500k. Let us suppose at the outset of the claim the defendant makes a part 36 offer at that level. The impact is shown in the graph below.

Figure 1 - Settlement graph showing the impact of a defendant part 36 offer of £500k for the 50:50 case where both parties believe they have a 50% chance of being successful at trial (assuming a claim value £1 million and both parties have expected legal costs of approximately £300k to trial). Note: The green dotted line shows the value of the part 36 offer to the claimant over time (the adverse cost consequences that follow if the offer is accepted after the relevant period make the offer less attractive over time and cause the line to dip ultimately falling outside of the settlement acceptance zone in the later stages of the case).

Although it is not particularly apparent from the graph the offer has had a small impact on the rational expected settlement line (reducing it by approximately £6.5k). The reason for this change is that if the defendant were successful at trial it would benefit from enhanced interest on its costs, which amounts to a benefit of approximately £13k. As there is only a 50% chance of that happening, the change to the expected award at trial is 50% of that figure – i.e. £6.5k.

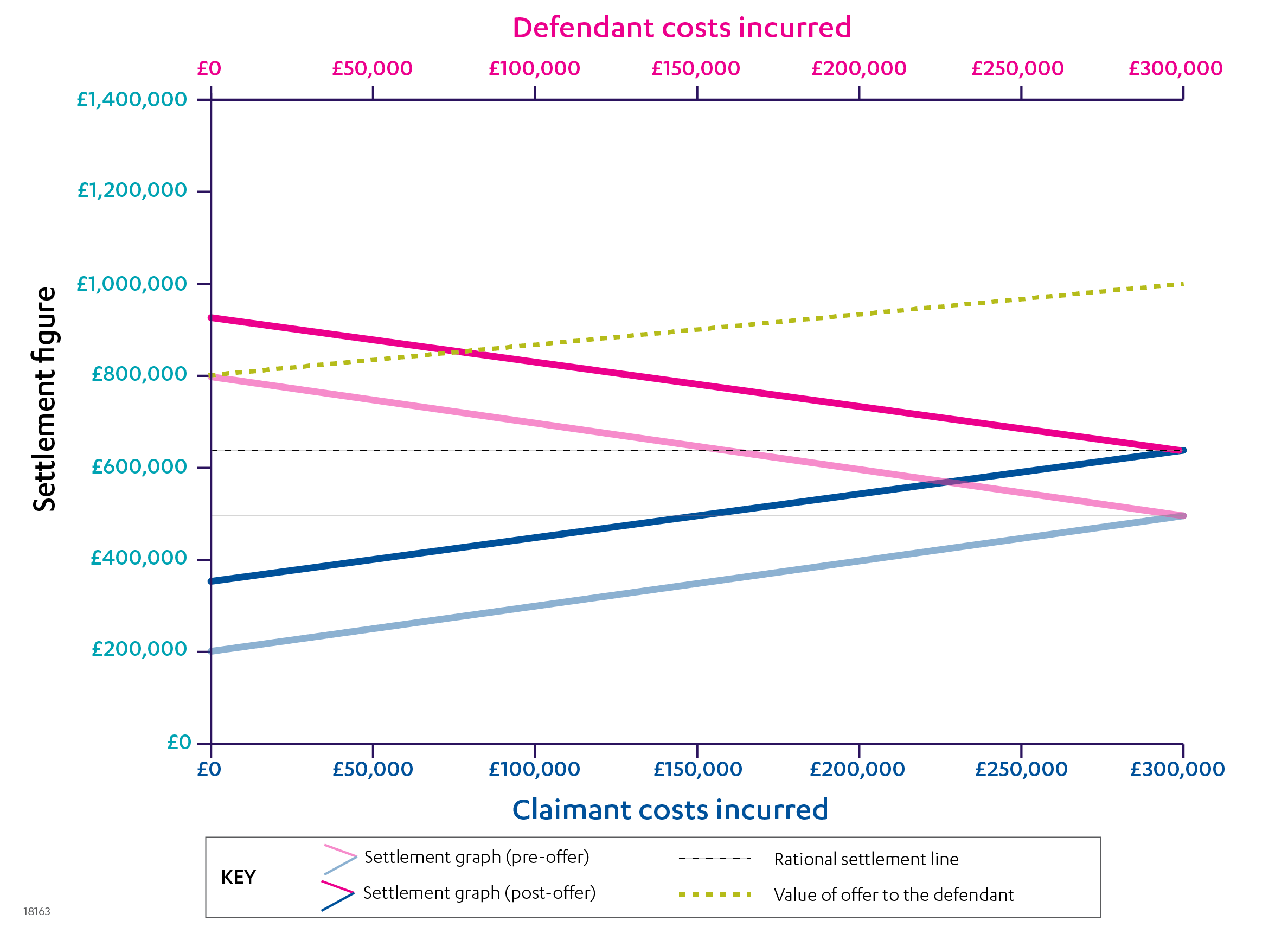

In contrast, the impact of a claimant part 36 offer is quite dramatic. The graph below shows the impact on the settlement position of a claimant part 36 offer of £800k made at the outset of proceedings (i.e. the very top of the settlement acceptance zone).

Figure 2 - Settlement graph showing the impact of a claimant part 36 offer of £800k for the 50:50 case where both parties believe they have a 50% chance of being successful at trial (assuming a claim value £1 million and both parties have expected legal costs of approximately £300k to trial)

The graph shows that the rational expected settlement line has increased considerably from the pre-offer level of £500k to approximately £640k leaving the claimant's expected recovery position improved by £140k. The two key mechanics driving this change are the enhanced interest payment the claimant would receive on its award if successful (8% of £1m x two years = £160k) and the sanction payment due under CPR 36.17(4), which at this level of award is maximised at £75k. On our current assumptions there is only a 50% chance of the claimant winning the litigation (and therefore the defendant failing to beat the offer) so the benefit to the claimant's position from these two factors is 50% of (£160k + £75k) = £117.5k.

In both cases the deployment of a part 36 offer is beneficial to the offeror and therefore a party to a case should consider making an offer (even if it represents only a modest discount to their primary position). The caveat to that is that too modest a discount is not likely to be viewed by the court as a genuine attempt to settle, which is a prerequisite for a part 36 offer to work. Although a detailed consideration of the caselaw behind part 36 offers is beyond the scope of this article it is worth noting that in Jockey Club Racecourse Ltd v Willmott Dixon Construction Ltd [2016] EWHC 167 (TCC) the claimants part 36 offer at 95% of its claim value was considered sufficient to be a genuine attempt to settle.

In our specific example, unfortunately for the defendant, there is little it can do to counter the fact that the claimant's part 36 is much more powerful than its own and has to accept that should the claimant make such an offer its position will be negatively impacted.

Late stage part 36 offers

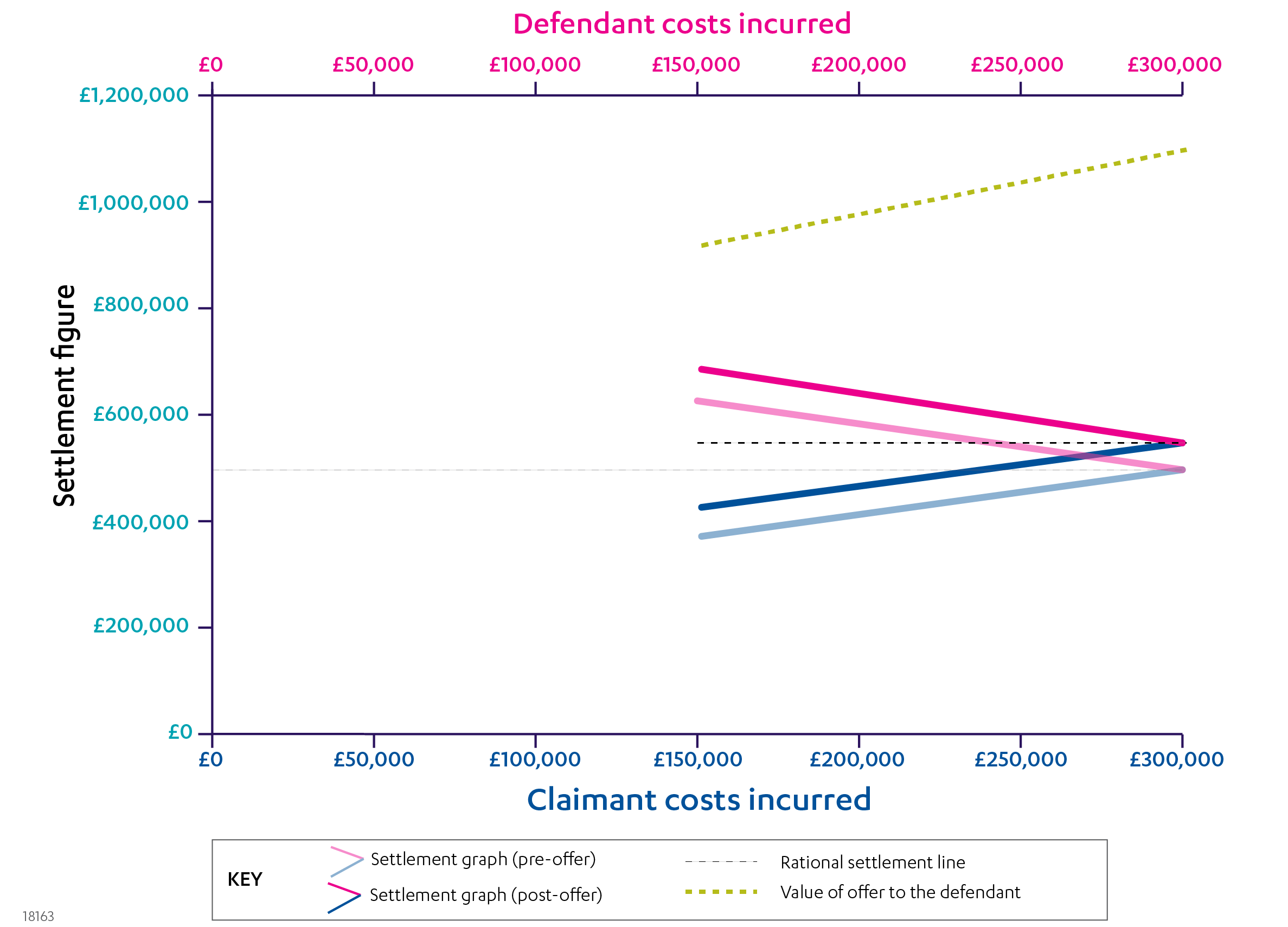

We have assumed so far that that the part 36 offers are made at the outset of the case. However, if instead we assume they are made later on in the case then their impact is still powerful but diminished. The graph below shows the same claimant part offer as in the previous example made halfway into the proceedings (after both parties have incurred £150k in costs).

As can be seen from the graph, the later part 36 offer moves the rational expected settlement line by £87k (about 40% less that if made at the outset). The reason the figure is not halved is that the sanctions payment remains maximised.

As the impact of a claimant part 36 offer diminishes the later in the case it is made, anything the defendant can do to reduce the probability of one being made is likely to be beneficial. This may well extend, against conventional wisdom, to not making an early part 36 offer of its own, which although beneficial might provoke a retaliatory claimant part 36 offer. In those circumstances the defendant might be best advised to wait until the claimant makes a part 36 offer (assuming it does at all) and only then make its own offer. From the claimant's perspective it will generally always be advantageous to make an early part 36 offer (even a non-competitive offer outside the settlement acceptance zone) once it has reasonable certainty of the expected award it is likely to receive at trial.

Summary

We have seen that part 36 offers benefit the offeror by moving the rational expected settlement line in their favour. The earlier in a case they are made the greater their beneficial impact. However, claimants in most circumstances are likely to benefit disproportionately from such offers.

Concluding remarks

As noted in the opening remarks to this series of articles, we hope their content will provide litigators with a new perspective and framework to think about litigation settlement.

A useful analogy can be drawn between litigation and the game of poker. In both you have to maximise your returns while dealing with incomplete information about your opponents and need to make educated guesses based on their actions. The best poker players are not only adept at reading their opponents but are also capable of quantifying the economic consequences of their assumptions – or in the parlance of the game - calculating the 'pot odds'. In so far as litigators can master both the psychological and the mathematical aspects of settlement tactics from the inception of a case they will be well positioned to deliver maximum value for their clients.