Time for public companies to come clean: New UK climate-related disclosures and ESG guidance

Companies listed on the London Stock Exchange's Main Market will need to include a statement in their annual report confirming if they have made climate-related disclosures consistent with the recommendations of Task Force on Climate-related Financial Disclosures (TCFD). Companies planning to IPO, or move from AIM to the Main Market, are also affected by these new Listing Rules.

Alongside these disclosure requirements, the Financial Conduct Authority (FCA) has published new guidance on environmental, social and governance (ESG) matters and companies' existing obligations under the Listing Rules, Disclosure Guidance and Transparency Rules, Market Abuse Regulation and the Prospectus Regulation.This blog looks at the new requirements, the FCA's ESG guidance, and the potential liability of directors for climate-related disclosures.

Why has the FCA introduced the new disclosure requirements?

In July 2019, the UK government published its Green Finance Strategy outlining plans to align the private sector financial system with the government's target of reaching net zero greenhouse gas emissions by 2050 through supporting investment in green and low carbon technologies, services and infrastructure.

The transition to a low carbon economy will have far reaching implications for businesses and will introduce new risks as well as new opportunities. The FCA believes increased transparency of how listed companies are affected by climate-related factors will improve market efficiency and allow investors to allocate capital in a way that supports the transition to a greener economy.

Which companies need to make climate-related disclosures?

The new requirements of Listing Rule 9.8.6 apply to all companies on the Premium Segment of the Main Market of the London Stock Exchange for accounting periods beginning on or after 1 January 2021. This means that the first annual reports subject to the new rules will be published in spring 2022. However, several companies have already begun to voluntarily include in their annual reports climate-related disclosures which follow the TCFD recommendations.

For now, companies on the Standard Segment, companies quoted on AIM and UK private companies are not required to include a compliance statement or related disclosures in their annual reports. However, in its Policy Statement on Listing Rule 9.8.6, the FCA noted that the Department for Business, Energy & Industrial Strategy (BEIS) will consult in 2021 on climate-related disclosure obligations for certain UK registered companies, which may include private companies as well as companies on the Standard Segment and AIM.

What are the TCFD Recommendations and Recommended Disclosures?

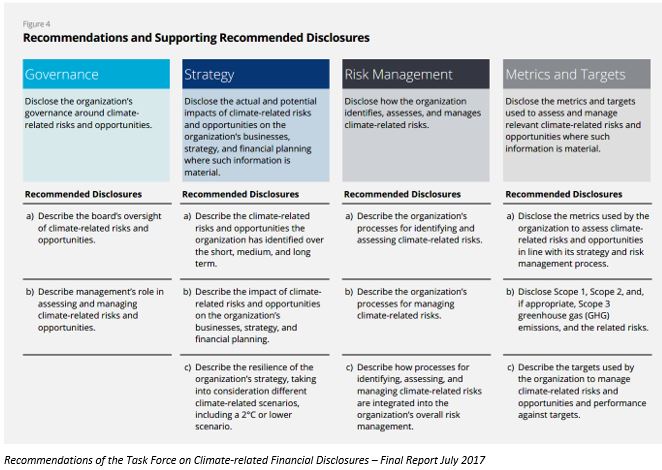

The TCFD was set up in 2015 to identify the information needed by investors, lenders and insurance underwriters to assess the climate-related risks and opportunities faced by companies. In its final report in 2017, the task force set out the following 4 overarching recommendations and 11 recommended disclosures.

These recommendations provide a useful and widely accepted framework to enhance and structure climate-related disclosures and support decision making by investors, management and other stakeholders.

What guidance is available to help companies draft these disclosures?

The TCFD has published guidance to assist businesses in different sectors prepare relevant climate-related disclosures. The new Listing Rules references this guidance as being relevant to determining whether a company's disclosures are consistent with the TCFD's recommendations.

The following guidance for drafting climate-related disclosures is available on the TCFD's website:

- TCFD Guidance for all Sectors

- TCFD Supplemental Guidance for the Financial Sector

- TCFD Supplemental Guidance for the Non-Financial Sector

- TCFD Technical Supplement

- TCFD Guidance on Risk Management Integration and Disclosure

- TCFD Guidance on Scenario Analysis for Non-Financial Companies

Do these climate-related disclosures need to be included in the annual report?

The new rules require Premium Segment companies to include a statement in their annual report on whether or not they have made disclosures (i.e. in the annual report or elsewhere) consistent with the TCFD recommendations. However, the FCA encourages companies to also include the underlying disclosures in their annual reports, as this is the approach recommended by the TCFD.

If some or all of the relevant disclosures are set out a document other than the annual report (for example, a separate sustainability report), the company must include in its annual report a description of where the disclosures have been made and an explanation of why it has not included the disclosures in the annual report.

Can companies choose not to include these disclosures?

The FCA has adopted the new disclosure requirements on a "comply or explain" basis. If a company chooses not to make disclosures in line with all the TCFD recommendations, it must include a statement in its annual report setting out the recommendations for which it has not included disclosures, the reasons for not including these disclosures, details of any steps it is taking to make those disclosures in the future, and the timeframe within which it expects to be able to make those disclosures.

The FCA believes a "comply or explain" regime is a proportionate approach while companies are building their capacity to monitor and plan for climate-related risks and opportunities. However, the FCA is already considering strengthening the compliance basis of the rule which could result in these disclosures becoming mandatory at a future date.

Do climate-related disclosures need to be verified by an external advisor?

The new rules do not require companies to have their climate-related disclosures, or their statements of compliance, confirmed by an external advisor. Companies may decide to obtain third party assurance on a voluntary basis, and this is likely to be the approach taken by many companies who do not have the internal resources to carry out a detailed analysis of the relevant climate related disclosures.

The FCA has commented that it sees significant value in third-party assurance of listed companies' TCFD-aligned disclosures on a longer-term basis and it will work with BEIS, other government departments and the FRC to develop UK policy in this area.

How do the new disclosure requirements affect companies planning to IPO on, or transfer to, the Premium Segment?

New applicants for admission the Premium Segment, whether through an IPO or transfer from AIM or the Standard Segment, are required to have established procedures which enable the applicant to comply with the Listing Rules and the Disclosure Guidance and Transparency Rules on an ongoing basis, including the new requirements on climate-related disclosures.

New FCA Technical Note providing guidance on ESG disclosures

The FCA has published a new Technical Note to help listed companies assess their wider disclosure obligations in relation to climate change and other ESG matters under the Listing Rules, Disclosure Guidance and Transparency Rules, Market Abuse Regulation and the Prospectus Regulation.

The FCA acknowledges that 'ESG' encompasses a broad set of topics and it does not seek to provide a fixed definition of ESG in the guidance note. Instead, the guidance note is intended to clarify that, when assessing existing disclosure obligations, companies should assess any ESG considerations which may be material to the business.

Could climate-related or other ESG disclosures expose directors to additional liability?

Potential liability for these disclosures may be a concern for companies and their directors, particularly as they may require companies to make forward-looking statements. For example, one of the TCFD's recommendations is to disclose the resilience of a company's business strategy in light of different possible climate-change scenarios.

Before these new Listing Rules took effect, UK companies were already required make disclosures on risks and uncertainties relevant to the financial performance and prospects of the business. For example, certain companies must disclose material issues such as policies on environmental matters, employees, social, community and human rights. Similarly, the FRC's Guidance on the Strategic Report recommends that companies include in their annual reports details of the principal risks they face and how these might affect future prospects.

Certain parts in the annual report already benefit from a safe harbour under section 463 Companies Act 2006. This provides that the directors can only be liable to the company, and not any other person, for the disclosures and statements required by law to be included in the directors' report, strategic report, directors' remuneration report and any separate corporate governance report. However, in its response to the FCA's consultation on Listing Rule 9.8.6, the Company Law Committee of the City of London Law Society noted that it is unclear if the section 463 safe harbour applies to the new climate-related disclosures. The FCA has responded that it may consider what, if any, additional legislative changes or guidance is appropriate when it looks at whether to make these requirements mandatory for all listed companies.

Directors are not expected to have a crystal ball that provides a perfect forecast of the company's, or the planet's, future. But they are expected to take reasonable steps to ensure that climate-related and other ESG disclosures are not untrue or misleading. Irrespective of whether a safe harbour applies, when making disclosures which require the company to make assumptions and forward-looking statements, directors should ensure that the company has in place robust processes for assessing the relevant available data, including third party forecasts, and that they have a well documented record demonstrating a reasonable basis for making any statements about the potential climate-related risks and opportunities faced by the business.