Crypto Assets and ICOs as seen by the SMSG - Part 2

Part 2: Trends and Regulation

On 19 October 2018, the Securities and Markets Stakeholder Group (SMSG) published a report on initial coin offerings (ICOs) and crypto assets. The report is a useful one-stop shop for relevant definitions, classifications and statistics and we summarise the highlights in this two-part series.

Market Trends

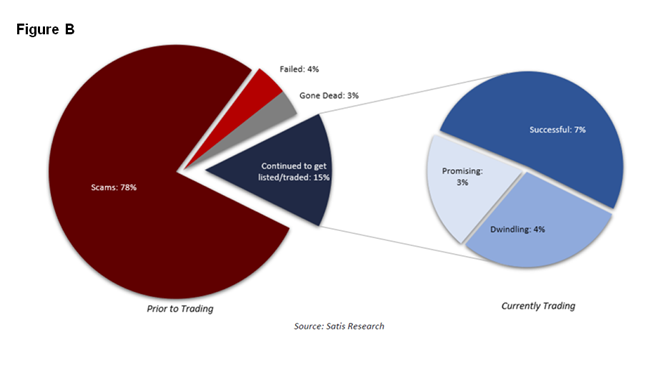

After setting out its definitions and classifications (explored in Part 1 of this series[1]), the SMSG considers recent market developments in the virtual asset world and makes use of revealing graphics produced by Satis Group[2] to highlight notable trends.

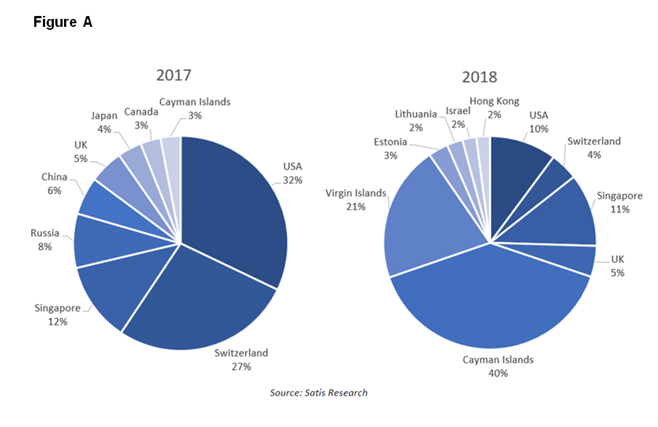

The charts at Figure A show the marked difference between countries issuing crypto assets from 2017 to 2018. Whilst the big players in 2017 were the USA and Switzerland, risk awareness and regulatory activity beginning to stir in those jurisdictions has had the effect of shifting the focus towards less regulated, or unregulated, jurisdictions.

EU Jurisdictions: Approaches to Regulation

The SMSG undertook a major exercise in reviewing regulatory approaches of securities agencies to ICOs and crypto assets in 36 European jurisdictions. Their findings offer an insight as to the spectrum of regulatory proactivity across Europe and the countries which feature at either end of it.

While the SMSG found that none of the jurisdictions examined had imposed severe limitations or outright bans for ICOs and crypto asset initiatives, countries such as Malta, Switzerland, Lithuania, Gibraltar, Jersey and the Isle of Man were ahead of the pack in terms of active engagement. Engagement in this sense indicated that a country was expressly legislating and developing specific methodologies, criteria or guidelines for assessing how and to what extent ICOs could be considered as financial instruments and thus fall under financial services framework.

A number of countries are clustered mid-table, adopting what the SMSG call a "wait and see" approach. Austria, Belgium, Bulgaria, Denmark, Estonia, Finland, Germany, Ireland, Luxembourg, Netherlands, Portugal, Spain, Lichtenstein and Guernsey and the UK all fell into this category – these jurisdictions have not specifically restricted or prohibited ICOs or crypto asset initiatives but maintain a watchful eye and measured approach, wary of legislative instruments already in force in the territory.

The third tranche of countries the SMSG identified were those that had taken no apparent position as to regulation of ICOs or crypto assets. The SMSG acknowledged that a lack of available information did not necessarily mean that initiatives were entirely restricted nor permitted. Countries in this category included Croatia, Czech Republic, Greece, Hungary, Italy, Latvia, Poland, Republic of Cyrprus, Romania, Slovakia, Slovenia, Sweden, Norway and Iceland.

Regardless of the regulatory approach for crypto asset issuers, the SMSG found that securities authorities in nearly all of the jurisdictions had published warnings to the public about investment risk. While the majority of these had emerged around the time of ESMA's dual reports in November 2017[3], which were aimed at investors and firms respectively and described ICOs as "very risky and highly speculative investments", the SMSG found that some authorities had been alerting consumers to cryptocurrency risks as early as 2013. Ultimately though, the vast number of investments in crypto assets across Europe over the past 12 months indicates the warnings have done little to dissuade, particularly given that many investors admitted to buying crypto assets without carrying out checks or considering the issuer's white paper. The report advises that investor protection relies on jurisdictions establishing and maintaining a robust regulatory framework and enforcement regime.

Having taken stock of trends and developments across Europe, the SMSG warned that the various divergent approaches to regulation of crypto assets had created an uneven playing field, hampering the creation of an internal market in the field. It recommended that ESMA take steps to provide much-needed clarity on the application of existing regulation to crypto assets, for the benefit of all involved.

[2] https://research.bloomberg.com/pub/res/d28giW28tf6G7T_Wr77aU0gDgFQ

[3] See https://www.esma.europa.eu/sites/default/files/library/esma50-157-829_ico_statement_investors.pdf for investors and https://www.esma.europa.eu/sites/default/files/library/esma50-157-828_ico_statement_firms.pdf for firms involved in ICOs.