HMRC withdrew more Accelerated Payment Notices than it issued last year

HMRC has been forced to withdraw more of its controversial Accelerated Payment Notices (APNs) than it issued last year says RPC, the City-headquartered law firm. HMRC withdrew 370 incorrectly issued APNs compared to just 220 that were issued in 2019/20*.

- Number of withdrawn Accelerated Payment Notices now exceeds 9,000

- Suggests HMRC hasn’t been exercising sufficient care

Under the APN regime, HMRC can demand taxpayers pay in full the amount of tax HMRC claims it is owed. Neither the liability itself or quantum needs to be established by the Tax Tribunal or Courts. The tax demanded must be paid within 90 days and there is no right of appeal.

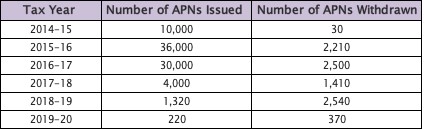

RPC says that the high number of APNs withdrawn in recent years (see table below) suggests that a significant proportion of notices have been sent to taxpayers in error. HMRC has previously been accused of failing to undertake the necessary checks to make sure all APNs it issues fulfil the necessary statutory criteria and are lawful.

9,060 APNs, which is more than 10% of all APNs issued, have been withdrawn by HMRC since the regime was first introduced in 2014.

Whilst the number of APNs withdrawn has been rising, the number issued has decreased in recent years, down from a high of 36,000 in 2015/16.

HMRC has previously attracted criticism for its over use of APNs in the past, particularly given the short time frame in which payment must be made and the lack of a right of appeal.

Adam Craggs, Partner and Head of Tax Disputes at RPC says: “We have acted for a large number of clients who had their APNs withdrawn by HMRC as we were able to demonstrate that the necessary statutory pre-conditions had not been satisfied and the APNs were therefore unlawful."

“The high proportion of APNs that have been withdrawn suggests HMRC has been a little trigger happy when issuing APNs. Taxpayers who have been wrongfully issued with an APN should consider pursuing repayment from HMRC.”

RPC says: "Despite the decline in the number of APNs being issued, it is likely that HMRC will continue to focus on generating increased revenue for the Exchequer following the enormous increase in public spending due to the coronavirus pandemic, but it does need to ensure that it exercises its powers in a proportionate and lawful manner.

*HMRC, year-end, 31st March

Number of APNs issued and withdrawn since the regime began