Litigation against top 50 global banks up 37% in a year

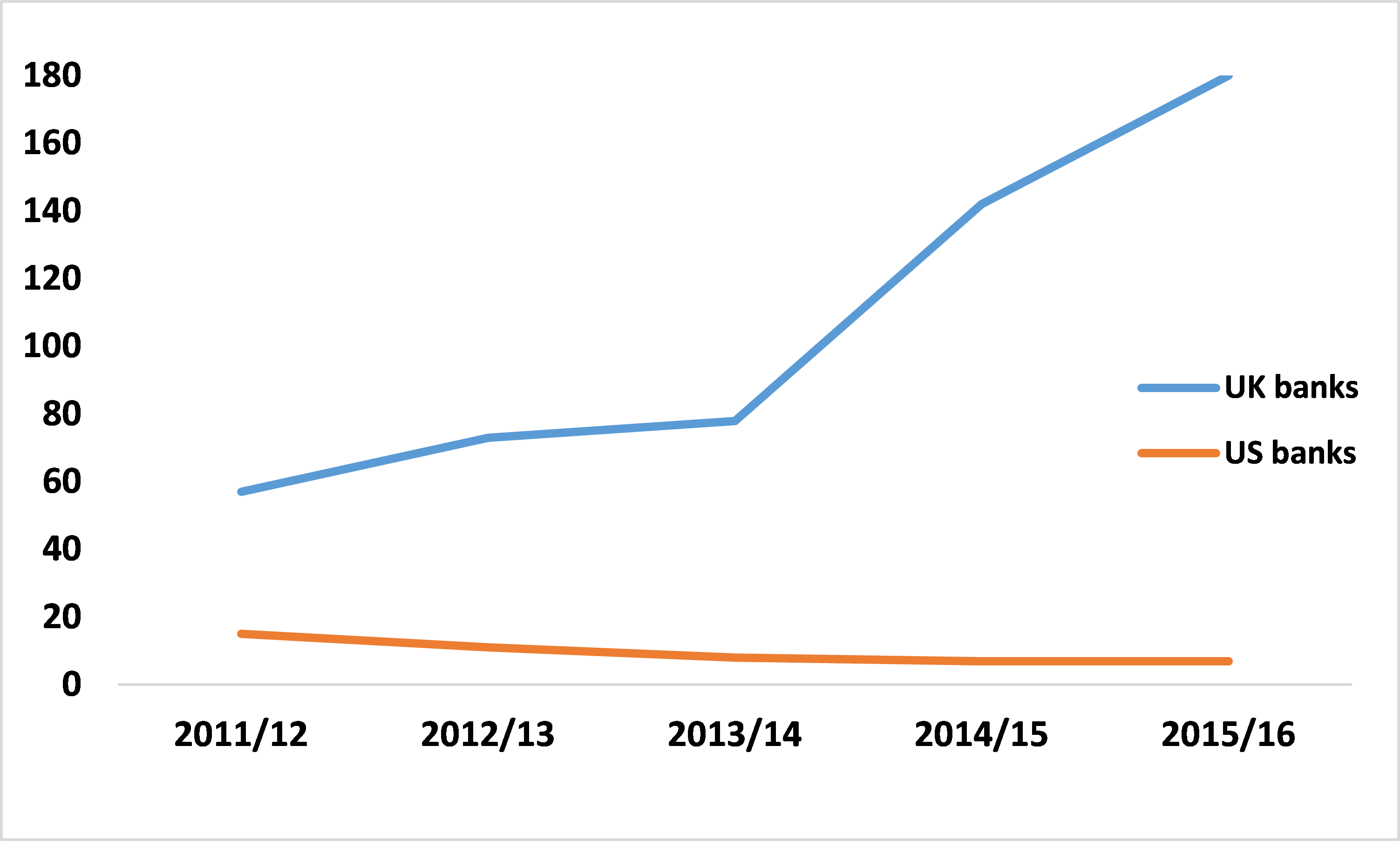

UK banks accounted for two thirds of High Court cases involving the world’s largest banks over the last five years.

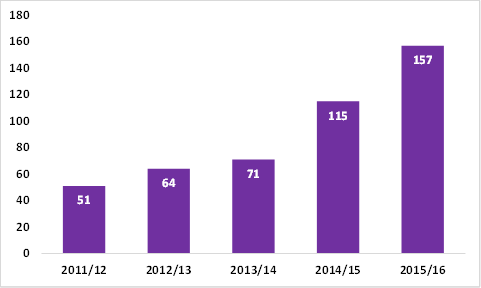

The number of High Court cases the world’s 50 largest banks have been forced to defend has increased by 37% in the past year, from 115 to 157*, as post crisis-era disputes show no sign of abating, says City-headquartered law firm RPC.

The latest figures show that the number of new High Court cases in which these banks have been defendants has increased consistently year-on-year, up from 51 in 2011/12, with no sign of slowing down (see graph).

RPC says the long-term fallout from the financial crash of 2008, together with a greater willingness on parties to contemplate litigation than was seen a decade ago has continued to drive litigation against the world’s largest banks.

The number of cases brought against banks stemming from the credit crunch, such as the misselling of hedging products and related disputes, remains stubbornly high and many cases may have only reached the High Court in the last year or so. This is because claimants typically have six years to launch a claim before their time limit expires.

RPC says that as the economy recovered, many businesses have found themselves in a better financial position to launch a legal claim than they were in the immediate aftermath of the credit crunch. This, alongside the availability of third party litigation funding, has driven many claims.

The firm adds that the sheer number of cases brought against banks, especially high-profile cases attracting media attention, may have galvanised individuals and businesses to follow through with claims which they might not otherwise have launched.

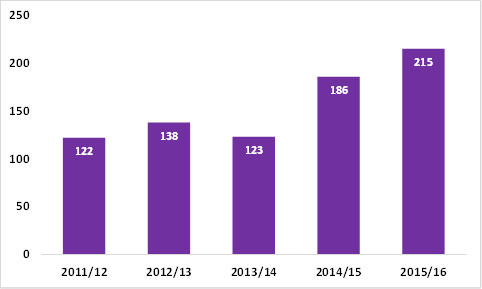

RPC says that over the last five years, the world’s 50 largest banks have been involved in a total of 784 High Court cases. In 58% (458) of those cases the banks have been the defendant.

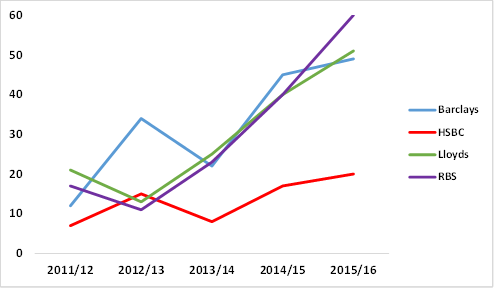

UK banks featured heavily with Barclays, HSBC, Lloyds and Royal Bank of Scotland (RBS) accounting for 67% (530) of the 784 High Court cases involving the Top 50. Of all banks, RBS was the defendant in the highest number of cases (118), whilst Barclays was second (106). There have been several high-profile cases involving these banks over the last few years. For example:

- The £4bn lawsuit brought against RBS and its former directors in 2015 by both individual and institutional shareholders who claim they were misled into signing up for a £12bn rights issue

- In 2014, Guardian Care Homes alleged that Barclays had missold it interest rate swaps worth £70m, claiming that it lost money because of the manipulation of the Libor rate

Simon Hart, Partner at RPC, says: “The number of claims against banks over the last five years shows the sheer impact of the credit crunch on the litigation market. Litigation was slow to arise in the immediate aftermath of 2008, but since then the banks have borne the brunt of the resulting disputes.

“Whilst the well-publicised systemic problems, like Libor or Forex manipulation, may not be repeated in the near future there is still a large number of disputes that pass across our desks every week relating to the investment banks.

“Of course, the hundreds of court cases that the banks have faced in London are likely to be dwarfed by the number of claims that banks have settled at an early stage.”

The number of High Court cases where the 50 largest global banks have been the defendant has increased 37% in a year – number of cases

The 50 largest global banks have been involved in 784 High Court cases over the last five years – number of cases

The number of High Court cases involving UK banks has increased year on year – number of cases involving each UK bank in the Top 50

Whilst the number of cases involving UK banks has increased, the number involving US banks has fallen – number of cases, UK banks vs US banks

*Based on an analysis of court hearing lists. Year ending December September 30