Litigation funders backing class action lawsuits as they put £2.2bn “war chests” to work

Funders backing class action suits due to extremely high potential returns

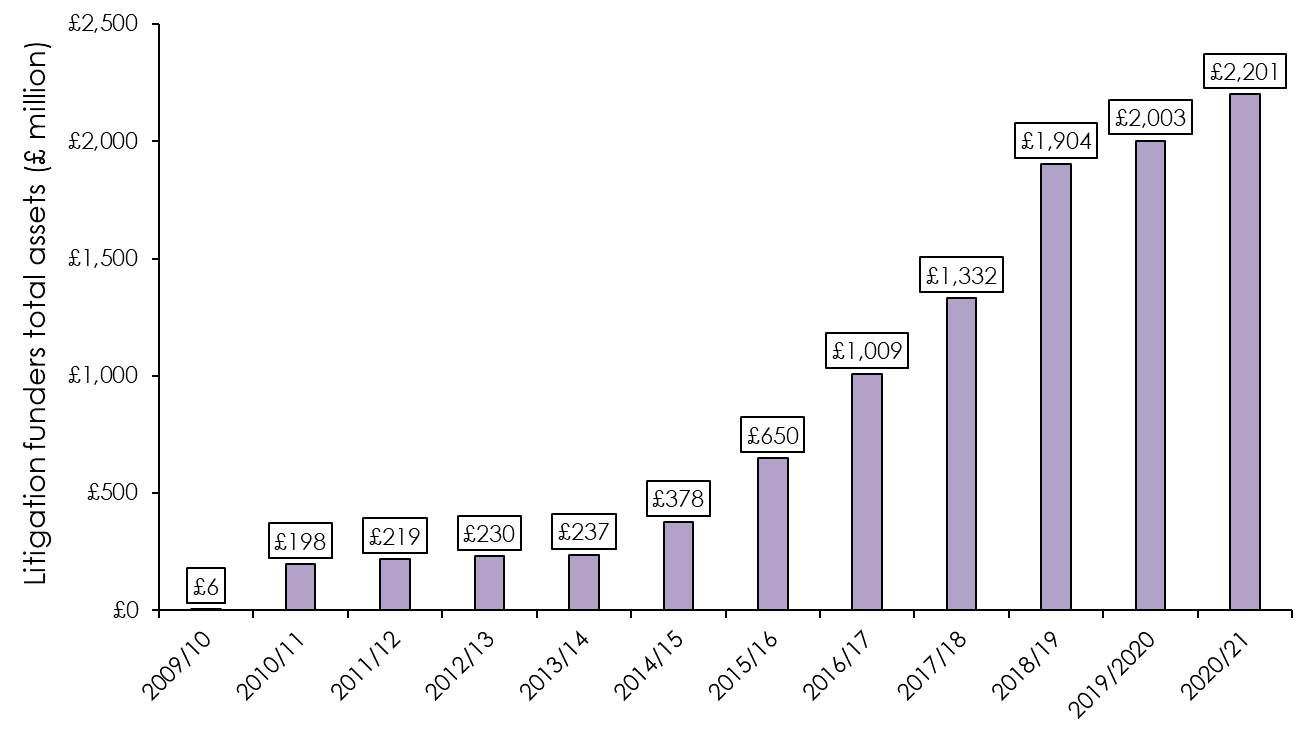

Value of assets held by litigation funders increases 11% in last year

UK litigation funders’ assets* have hit a record £2.2billion last year, an 11% increase on the previous year says international law firm RPC.*

The latest figures show a soaring trend that has seen litigation funder assets almost double over the last three years, from £1.3bn in 2017/18 and a more than ten-fold increase in value over the last decade (from £198million recorded in 2011/12).

Litigation funders pay for the legal costs of a company or individual’s case in exchange for a share of the proceeds of any damages or settlement that are won.

RPC explains that in order to deploy their additional capital, litigation funders are increasingly looking to fund new cross-border class actions.

As investors have tried to diversify away from equities and bonds, litigation funding has attracted a flood of extra capital which has to be deployed. As class actions can lead to awards that run into the tens of millions of pounds they can be an attractive investment for a litigation funder. A UK class action related to the VW “dieselgate” litigation has just settled for £193m.

Recent research by Thomson Reuters found that FTSE-100 companies are facing an increase in class actions, 170 class actions globally up 10% from 155 in the previous year.

Many of the world’s biggest legal damages awards have been in class action cases.

Chris Ross, Partner at RPC, says: “Class actions can bring big rewards for litigation funders. They allow a funder to deploy a lot of capital at once as they are expensive cases to run, but they can also be efficient investment vehicles, because each class action can attract hundreds or thousands of claimants.”

“Pretty much every class action case that takes place in the UK now has a litigation funder sitting behind it.”

RPC explains that litigation funders are particularly interested in funding class actions that involve a proven breach of European competition as these cases come with an established finding of liability meaning the disputed issues can be narrowed to causation and quantum.

Funders now have more assets than in any point the last decade as assets held by litigation funders have increased ten-fold – in 2010/11 funders held under £200m in assets.

Other methods that litigation funders are using to increase their pipeline of legal cases include:

- “buying books” of potential litigation from corporates;

- funding large debt collection cases; and

- funding insolvency practitioners to sue directors who may have negligently or deliberately caused their business to fail and left creditors out of pocket

Litigation funding has become increasingly popular among businesses and individuals involved in litigation as it allows them to pursue legal claims without risking their own money. It has become especially valuable to those who may not be able to afford litigation costs.

Chris Ross adds: “Some estimates suggest that 90% of cases put forward to litigation funders are rejected, underlining how selective funders are about the cases they take on. It also explains why litigation funders are now so active in looking for and even seeding new cases. They want to deliver a high ROI for their investors; that’s not easy when so much money is chasing the same legal cases.”

Assets held by litigation funders hits record high (£ million)

*Analysis of total assets held on the balance sheets of the Top 15 largest UK litigation funders, using data from Companies House and annual reports. Excludes independent funds managed by litigation funders as fund managers.