.jpg)

Rise in retail M&A – takeovers of distressed retailers represent 39% of all transactions

The number of M&A deals in the retail sector increased from 25 in 2019 to 28 in 2020, shows new research by RPC, the international law firm.

RPC’s study also shows that acquisitions of retailers that were in administration as a percentage of all retail M&A deals increased significantly over the past year, going from 20% of all deals in 2019 to 39% in 2020.

Retail has been one of the sectors of the economy that has been hit hardest by the pandemic. Many “non-essential” bricks and mortars retailers have been prevented from trading for most of the past twelve months, since the first national lockdown began in March 2020.

RPC says the pandemic has given some buyers in the retail sector the opportunity to acquire fundamentally sound businesses that are expected to recover later in 2021, for relatively low prices.

Online retailers are also increasingly looking to accelerate their growth strategies by adding the brand equity that established bricks-and-mortar retail brands have built over the years. This has made the intellectual property of some struggling high street retailers – particularly in clothing – an attractive acquisition target for online-only retailers.

There have been a number of takeovers of high-performing retail businesses. These have primarily been fast-growing e-commerce companies that have benefitted from the accelerated shift towards online shopping during coronavirus.

Examples of recent acquisitions of ecommerce businesses include:

- A majority stake in a popular e-commerce jewellery brand by a HNW investor

- A fast-fashion brand acquiring a competitor

- A retailer specialising in decorative lighting

Karen Hendy, Co-Head of Retail at RPC says: “M&A activity has held up well in spite of the challenges posed by the pandemic. We’re seeing investors make bolt on acquisitions or enter into new segments of the retail market.”

“The stock market value of the UK retail sector is now at its highest level since 2016. That suggests that retailers that expanded through acquisitions, in the darker days of 2020, have made well timed purchases and that there is confidence in the sector as a whole.”

“While very few will be keen on taking on leases for bricks-and-mortar stores for rents that are set too high within a business rates system that is completely out of date, nobody should write off the ability of the high street to bounce back. There is a lot of value in high street businesses, in their brands, their stock and their warehousing facilities.”

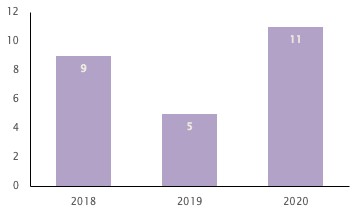

Acquisitions of struggling retail businesses more than doubled 2019-20