Carve-out deals: Preparation for separation

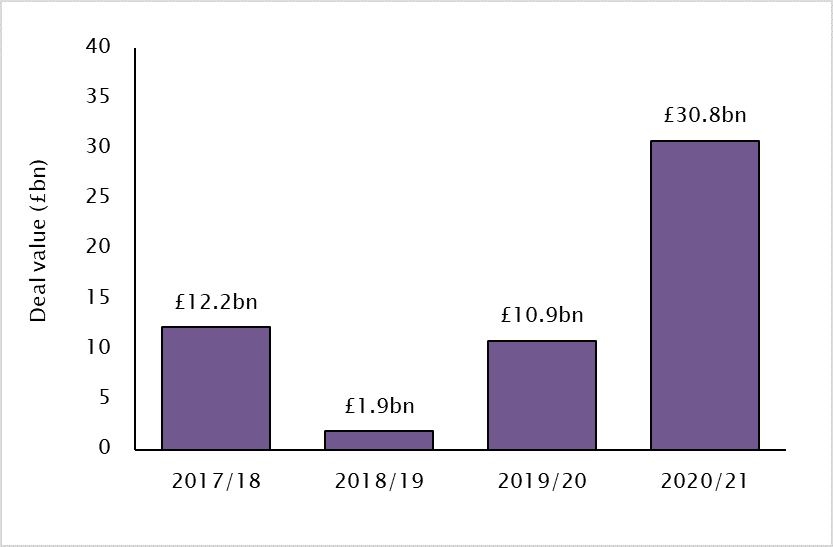

The value of UK carve-out deals is on the rise. Deal value increased by 182% to £30.8bn for the tax year 2020-21. Participants should be aware of the complex issues involved.

Carve-out deals typically involve the sale of a specific business unit or division, with the seller retaining the remainder of the business. As well as a way of shedding non-core assets, carve-outs can help companies strengthen their balance sheets by raising capital from disposals. The coronavirus pandemic has encouraged companies to focus their efforts on the more "core" or profitable parts of their business and to consider selling "non-core" businesses or businesses which are non-efficient or consume too much management time.

The commercial rationale for carve out deals is often complex and mixed. Reasons can range from financial or investor related pressures to strategic or regulatory motivations, amongst others. Sell-off businesses are often identified and prepared for sale on the basis that they have the potential to grow or to be valued or leveraged at different rates or in a different way compared to the retained business.

Companies considering a carve-out deal should not underestimate the complexities that often accompany this kind of disposal – these complexities are best mitigated by thoughtful preparation.

Separation

The important legal, operational and financial considerations in a carve-out transaction often relate to separation issues. These issues need to be handled carefully to avoid value leakage and loss of supply. The following are some simple examples of items which are likely to be key:

- Employees

The carved-out business and retained business will often share staff so TUPE and pension issues will need to be identified and addressed early. If the buyer is proposing to make any changes to the employees' terms, benefits or pensions, these will all need to be closely analysed in light of relevant restrictions under TUPE.

2. Intellectual property

Untangling IP rights used across different parts of the business can present difficulties, and the buyer will want to ensure that it acquires all the IP it needs to operate the carved out business, or ensure appropriate licences are put in place to the extent relevant IP rights cannot be acquired.

3. Real estate

Real estate arrangements will depend on whether the buyer will continue to operate the business from the same location post-completion, or whether the business will need to relocate. Relocation can cause major business disruption, but often remaining in the same place will require alternative arrangements and often complex co-ownership arrangements being negotiated and put in place.

4. Financial and tax

These will be areas subject to significant scrutiny. From a buyer's perspective assessing the value of the business to be carved out and operated on a standalone basis or as part of the wider buyer group often via separately prepared pro-forma financial statements for the purposes of the transaction will be critical. How costs have been shared between the parent company and the business being span out will also impact value and be a key area of the financial due diligence.

Preparation

Early preparation is critical for a carve-out deal.

By giving due consideration to how assets are to be separated and the structure needed ahead of going to market, sellers can enter into negotiations with a much clearer view of any potential issues. As a result, sellers are more likely to avoid delays, enjoy a competitive auction and avoid price chips during negotiations.

Common examples of major problems which arise and can derail carve-out deals are:

i. due diligence uncovers that a certain part of the spun-out business is crucial to the continued operation of the retained business to the extent that separation is unfeasible;

ii. the seller finds that a large tax liability will arise on separation;

iii. failure to obtain shareholder or third-party consent(s) to the sale; or

iv. failure to obtain all relevant regulatory approvals.

As a buyer, the integration of the target business into its own group needs to be reflected in the deal structure.

Transitional services agreements are widely used in carve-out deals to preserve business continuity – they typically require the seller to continue to provide certain services to the carved-out business following the sale, such as IT, payroll, tax, HR and other business support services. Ensuring the right transitional services arrangements are in place is important for successful integration.

It is rare for a disposal not to have some element of separation these days. Businesses rarely operate on a truly stand-alone business within corporate groups.