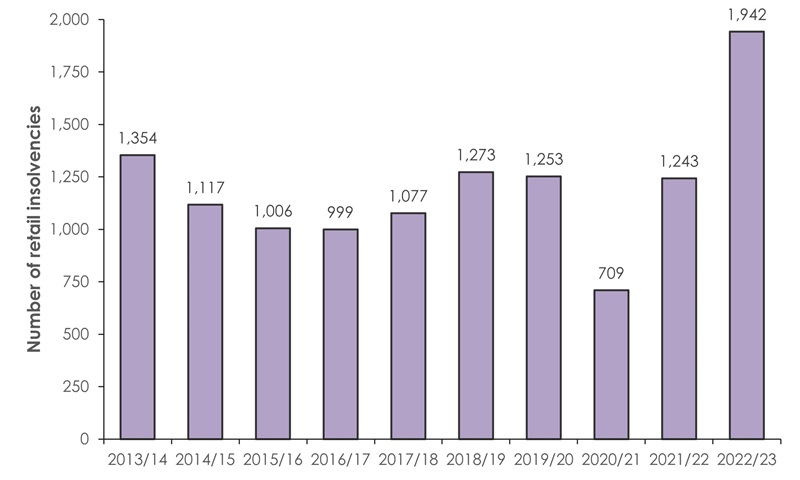

Insolvencies of retail businesses jump 56% in past year to hit decade high

Retailers that weather interest rate rises have an opportunity to grow market share.

Commercial landlords may need to do their part and be more flexible in lease negotiations.

The number of retail business insolvencies jumped 56% in the past year, to hit the highest levels in at least a decade - 1,942 in 2022/23, up from 1,243 in 2021/221 shows new research from international law firm RPC.

Despite the challenges faced by the sector, the insolvency of financially weaker retail businesses is creating opportunities for stronger players. These businesses may be able to increase their market share through strategic acquisitions of smaller competitors.

There were 34 retail M&A deals in 2022. Of these, just under a quarter (eight) were purchases of distressed businesses. High-profile retail sector insolvencies, such as Made.com and Joules, have all been saved by larger retail groups.

One way retailers can make strategic acquisitions is by purchasing businesses via pre-pack administration deals, where the sale of part or all the business is negotiated before the appointment of administrators takes effect.

The smooth transition facilitated by pre-packs enables businesses to continue operating, making them a more attractive asset. Pre-pack administrations can be beneficial in preserving jobs, preventing negative publicity with the impact of loosing goodwill and creating a higher return for creditors.

Finella Fogarty, Partner and Head of RPC’s Restructuring and Insolvency practice, says: “Challenging economic conditions over the past year have had the impact of forcing struggling retailers into insolvency.

“Retailers who are of questionable solvency may want to consider selling through a pre-pack administration if other restructuring options are unavailable to them or if they have failed. Pre-packaged deals ensure continuity and avoid the loss of goodwill and the inevitable uncertainty that comes with a trading administration.”

Landlords may negotiate on lease terms to fill vacant units as insolvencies rise

The current level of insolvencies amongst retailers means a continued supply of newly vacated retail property. Finella Fogarty explained that commercial landlords looking to fill these units may likely be more amenable to negotiating terms that are favourable to retail tenants. These may include lower rents, more generous payment terms, turnover-linked rents and greater flexibility in lease duration.

Finella Fogarty adds: “Landlords with a surplus of vacant units, particularly those outside of prime locations, will be eager to work with commercial tenants to arrive at a mutually beneficial solution. Some savvy retail operators are building a further lowering of rental costs into their business plans.”

Retail insolvencies hit a decade high in 2022/23 – up 56% in last 12 months

Stay connected and subscribe to our latest insights and views

Subscribe Here