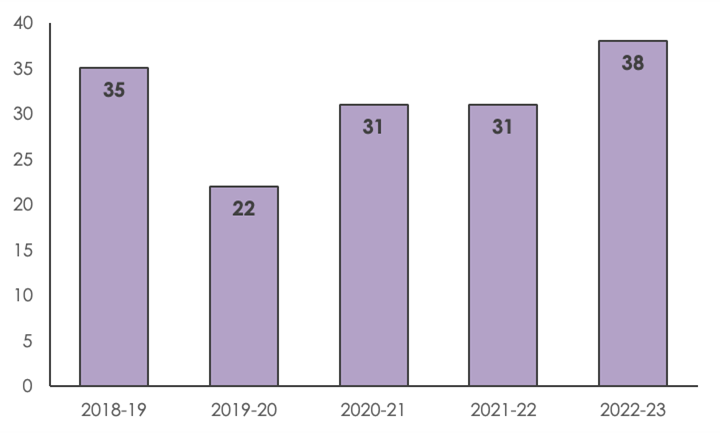

UK retail M&A deals increase 23% in the last year, a five-year high

Number of deals rose from 31 in 2021/22 to 38 for 2022/23

The number of M&A deals targeting UK retailers has increased 23% over the last year, from 31 deals in the year ending March 2022 to 38 in the year ending March 20231, marking the highest levels seen in five years, shows research by international law firm RPC.

In the previous quarter, the number of retail M&As jumped from five to 12 at the end of Q4 2022.

The research also revealed a decrease in the proportion of M&As involving the purchase of distressed assets.

While 50% of acquisitions in Q3 2022 were of distressed companies, this dropped to 33% in Q1 2023.

Karen Hendy, Partner and Co-Head of the RPC Retail group says: “Retailers with strong balance sheets are looking past the peak in interest rates and making strategic acquisitions for the long term.

“Accessing the wider pool of assets that is up for sale is enabling acquirers to break into some very specific consumer demographics and new areas of the market.

“One of the drivers for M&A is weakening demand as consumers cut back on discretionary spending. Some retailers misjudged how demand was going to be impacted by the turn in the interest rate cycle. Carve outs and disposing of non-core assets enables retailers to raise capital and strengthen their balance sheets as well as focussing on efficiencies and tighter inventory management.”

The research also revealed that private equity is gradually returning to retail with two acquisitions in Q1 2023, compared to zero the previous quarter and just one in Q3 2022.

Karen Hendy adds: “Retail has long been a staple in private equity portfolios and improved market conditions are seeing funds tentatively return to the sector. If sellers' expectations around valuations are realistic enough to offset the costs of borrowing, we could expect to see an acceleration in private equity funds acquiring retail businesses.”

Fewer businesses are taking on debt to finance acquisitions

Despite the overall resilience of the retail M&A landscape, the rise in interest rates has impacted how deals are financed. Successive rate rises have led some businesses to pay cash if they can afford to, rather than fund acquisitions through more expensive debt.

Retail M&A deals increase to 38 in 2022/23 - a five-year high

1 Year-end March 31